A notorious donor to Donald Trump and the broader MAGA movement recently acquired a significant portion of Germany’s energy infrastructure.

ABOUT US

The Anti-Corruption Data Collective brings together leading journalists, data analysts, academics and policy advocates to expose and undermine corruption.

Find out moreLATEST ARTICLES

Investigations

Investigations

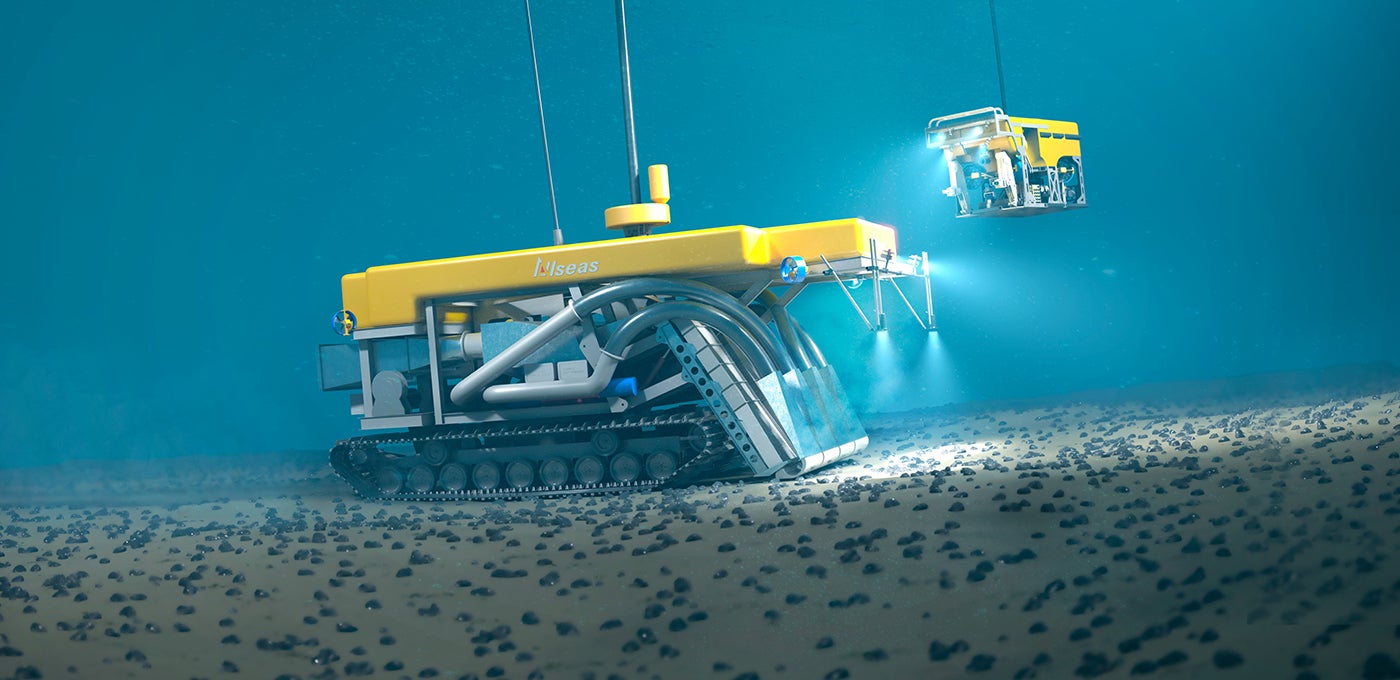

An American oligarch acquires critical energy infrastructure in Germany

A notorious donor to Donald Trump and the broader MAGA movement recently acquired a significant portion of Germany’s energy infrastructure.

Inside the Congo Hold-Up

OUR FOCUS AREAS

Money laundering risks in private investment funds

Trillions of dollars are invested worldwide in private investment funds (PIFs), which include hedge funds, private equity, venture capital and other pooled vehicles. Yet in most countries, and in the US in particular, these funds are subject to even weaker anti-money laundering checks than other types of legal entities, including shell companies.

Read More

Real estate markets open to criminals and the corrupt

Real estate offers kleptocrats and other criminals an easy, opaque asset class to launder their ill-gotten gains. Moreover, when real estate is used as a safe haven for the proceeds from criminal activity, access to housing is reduced and ordinary residents struggle to afford properties for their family or business.

Read More

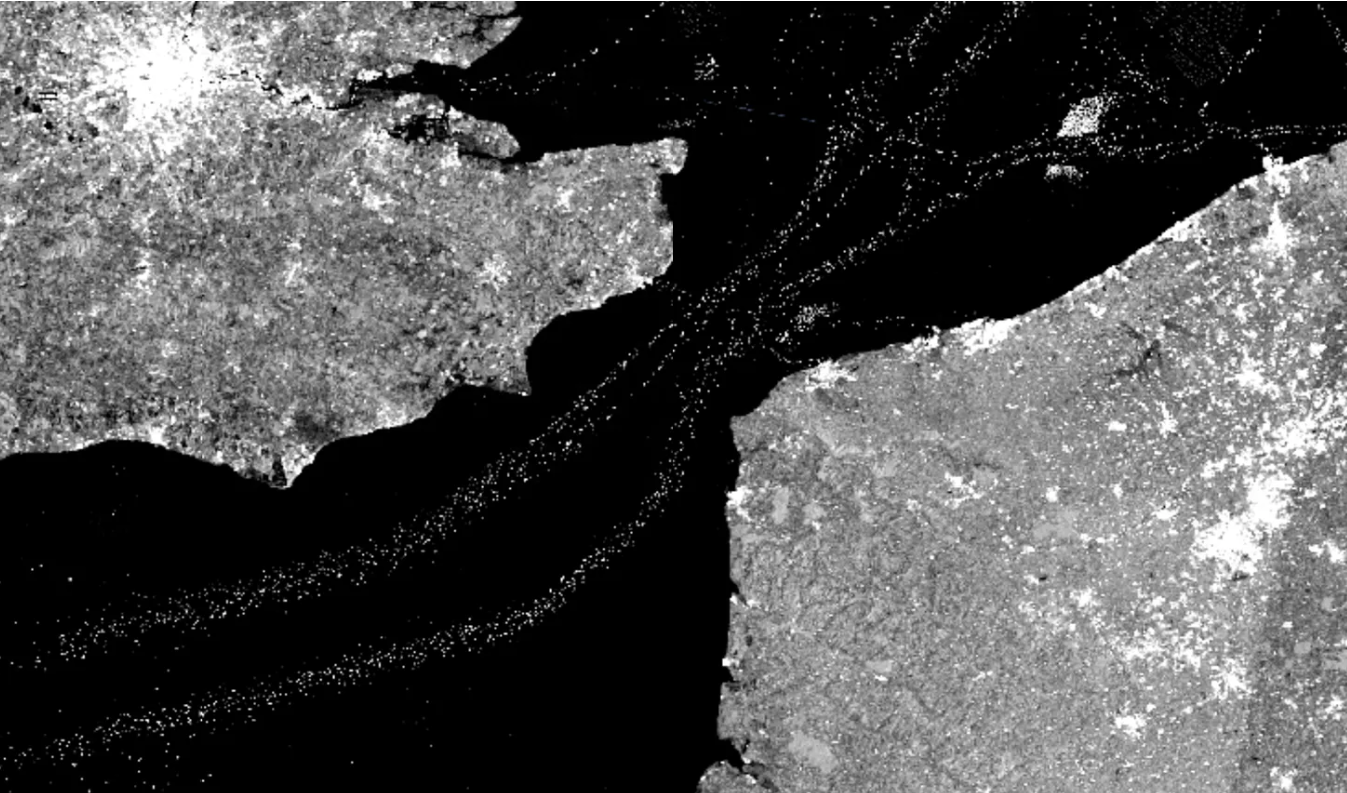

Opacity in trade finances kleptocracy

Before corrupt officials launder their ill-gotten gains through sectors like real estate and private investment funds, the international trade in commodities creates opportunities for illicit enrichment through bribery and embezzlement. Much of this trade involves ...

Read More