“Necessary but not sufficient”: ACDC urges FinCEN to finalize and build upon strong AML rule for investment advisors

For the past twenty years, private investment funds in the U.S. have been operating under a “six-month” temporary deferral exempting them from regulatory requirements to adopt anti-money laundering and counter-terrorism finance programs required of most other financial institutions. In this time, the size of the industry has doubled.

Unregulated invesmtent advisers now manage 47,443 private funds holding $20.9 trillion in gross assets.

The Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) is once again attempting to fix this enormous chink in the financial system’s defensive armor against dirty money.

In a rule proposed earlier this year, FinCEN sets out to expand the scope of its previous – ultimately unsuccessful – effort in 2015 by bringing Exempt Reporting Advisors (ERAs) managing under $150 million in assets into the scope of requirements to adopt an AML compliance program, file suspicious activity reports (SARs), and share information with authorities upon request. This is a critical step for, as FinCEN notes, these venture capital or smaller hedge or private equity funds often pose a higher risk than Registered Investment Advisors (RIAs) managing larger hedge or private equity funds. ACDC’s analysis of these categories of private investment funds’ SEC filings over the past twenty years finds that unknown foreign individuals control $1.7 trillion in U.S. private investment fund assets.

In a public comment submitted today, ACDC commends FinCEN on its proposal, and highlights three important areas for improvement:

1) ACDC recommends that FinCEN expand the definition of advisers beyond RIAs and ERAs to include managers of family offices and of certain real estate-focused funds.

2) FinCEN must, as it intends to, apply beneficial ownership rules that require advisers to determine the natural person beneficial owners of limited partner investors.

3) FinCEN should work with partner agencies to address critical transparency and national security gaps involving private funds that will remain even after the entry into force of AML requirements for advisers.

Informing much of our comment is ACDC’s analysis of ownership data for 56,134 unique funds contained in thousands of Form ADVs submitted by RIAs to the Security and Exchanges Commission (SEC).

Press release: Unknown foreign individuals control $1.7 trillion in U.S. private investment fund assets – Anti-Corruption Data Collective

Most private funds have many owners. On average, private funds in the SEC data we looked at report 172.4 unique beneficial owners. However more than one quarter, including many with significant assets under management, exhibit surprisingly concentrated ownership: 15,850 funds (28% of the total sample) list three or fewer beneficial owners. Almost half, 25,387 funds (or 45% of the total sample) have 10 or fewer beneficial owners.

Fifty percent of the funds in the dataset also have some non-US ownership. We calculate that out of $21 trillion in private fund assets under management, $8.4 trillion (40%) is owned by unkown non-U.S. persons. As noted in our comment, this significantly impacts the ability of The Committee on Foreign Investment in the United States (CFIUS) to review the national security implications of foreign investments in the U.S. routed through private investment funds.

On paper, at least, CFIUS would not have the legal authority to review an investment in a company developing an emerging critical technology, even if 100% of the money came from a hostile foreign government, as long as the money was routed through a private fund managed by a U.S. adviser.

It is all the more important that FinCEN work with partners to address this problem when you consider that ACDC also identified 4,960 unique private funds that by definition are controlled by private foreign individuals. These funds list three or fewer beneficial owners and at least 50% non-U.S. beneficial ownership. Collectively, these funds with concentrated, non-U.S. beneficial ownership manage $1.7 trillion in assets. The true owners of these funds are unknown to the U.S. government.

Coruption, tax evasion, corporate espionage and sanctions busting

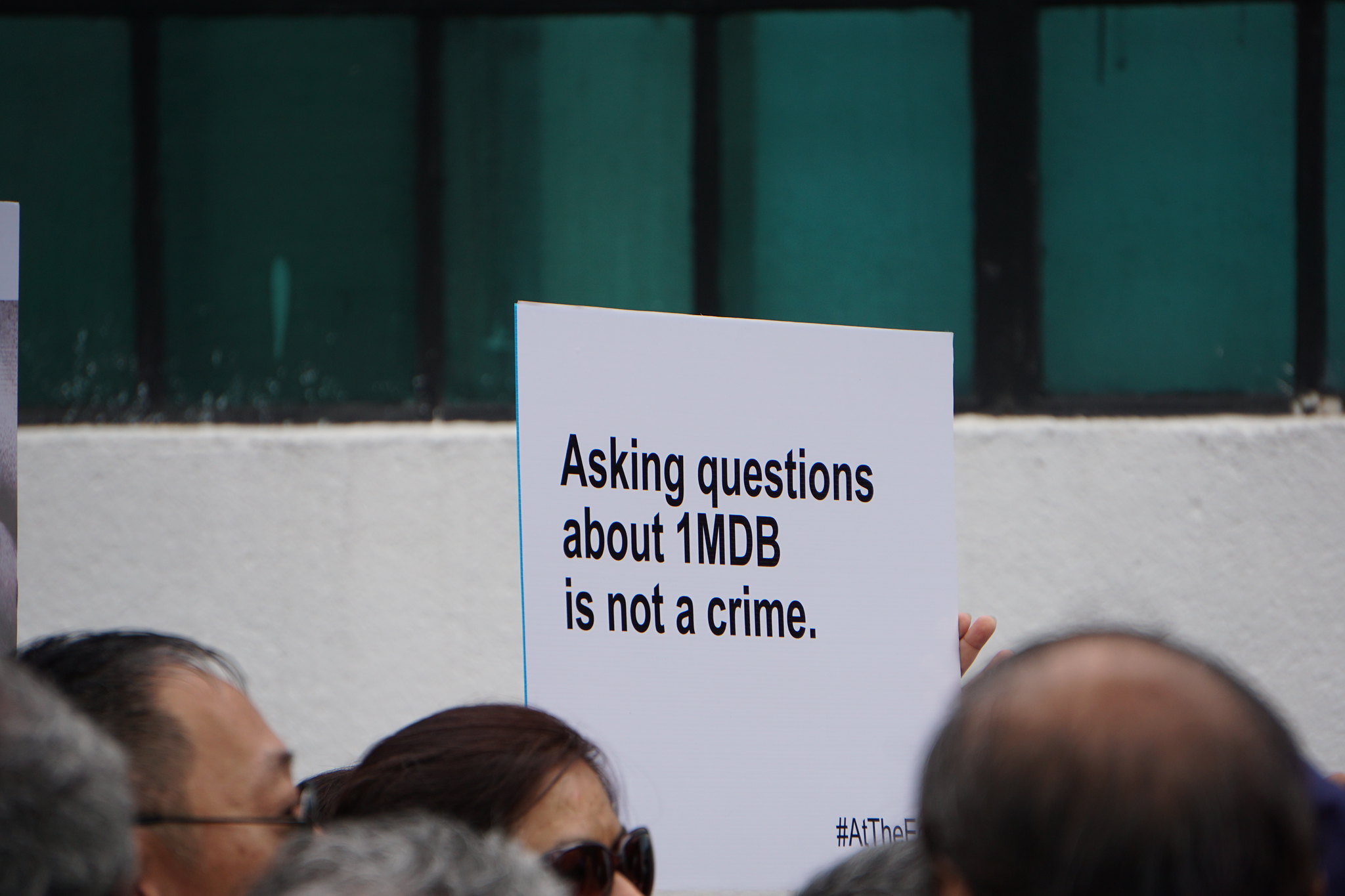

In its proposal, FinCEN highlights prominent public corruption cases involving the use of private funds, such the theft of funds from a state investment fund in Malaysia and an oil-related case in Venezuela. Closer to home, FinCEN could also have mentioned a 2020 Justice Department case in which a wealthy executive admitted to using private equity funds to avoid reporting more than $200 million in income as part of an illegal tax evasion scheme.

FinCEN also details numerous examples of actors tied to Russia or China accessing critical or emerging technologies in the U.S. through private funds. The agency states that “Russian elites and government entities are moving hundreds of millions of dollars annually through the U.S. financial system by using U.S. and foreign venture capital firms to invest in U.S. technology companies.” The Federal Bureau of Investigation has warned that the Chinese government “routinely conceals its ownership or control of investment funds to disguise efforts to steal technology or knowledge.”

FinCEN alaso notes that more than 20 U.S. advisers to private funds were identified as “having significant ties to Russian oligarch investors or Russian-linked illicit activities” and that more than 60 additional U.S. advisers have managed private funds “in which identified Russian oligarchs have invested.” Press reporting in the New York Times, Washington Post,and Wall Street Journal reviewed by the FACT Coalition reveals that advisers to private funds may not always know the identity of their investors and are likely unaware of the full extent of their potential exposure to sanctions against Russia.

Concentrated and opaque ownership and control of private funds, whether foreign or U.S., increases the risk of them being abused. Moverover, if advisers to private funds are not required to identify the beneficial owners of all significant legal entity limited partner investors, the value of the due diligence, transaction monitoring, and suspicious activity reporting will be substantially limited.

In a similar vein, it is critical that as FinCEN introduces AML coverage for RIAs and ERAs, it does not leave open loopholes around categories of investment advisors that also post illicit finance risks.

Family offices, for instance, can only accept money from “family clients”, but this can include anyone connected by a single common relative within ten generations of lineal descent. It also includes former spouses, certain non-profit entities, family companies, and certain “key employees” of the family office. The only way to know the source of funds being invested by the family office, and the identity of the investors, is for FinCEN to ask.

Likewise, pooled real estate investment vehicles are structured similarly to private equity, hedge, or venture capital funds, with limited partners investing money into a partnership advised by general partners who manage or advise the fund. ACDC has recently completed a report on illicit finance risk in the commercial real estate sector, jointly authored with Global Financial Integrity and the FACT Coalition. The report finds that billions of dollars of suspicious funds have been invested in U.S. commercial real estate over the past two decades, including a prominent case involving a now-sanctioned Russian oligarch that utilized a managed investment fund.

U.S real estate is well known to be highly attractive to the criminal and corrupt seeking to launder and enjoy their ill-gotten gains. A loophole around funds managing investments in this sector would be obvious and inviting to bad actors.

Necessary but not sufficient

The high risk and incredible volume of money being invested through U.S. private investment funds makes it essential that FinCEN improve, finalize and implement its proposed rule. It must also go further, and work with CFIUS and other agencies to ensure that mysterious foreign investors are not abusing private funds to launder ill gotten gains, avoid sanctions and access critical emerging technologies.

For the full comment, see: https://acdatacollective.org/work/acdcs-public-comment-on-proposed-aml-requirements-for-investment-advisors/