Diving deeper into Commercial Real Estate: EB-5 Visas

A recent report by ACDC, Global Financial Integrity and the FACT Coalition identified at least $2.6 billion worth of suspicious or downright illegal investments in the U.S. commercial real estate sector in recent years. In two of the cases we reviewed, the EB-5 Immigrant Investor Program played a role in illicit capital entering the US financial system. Here we take a closer look at those cases.

What is the EB-5 program?

An EB-5 visa is a means for foreign nationals to gain a US residency permit, commonly known as a Green Card, in return for a minimum two-year investment in the US economy which creates 10 new jobs. These investments are often placed in cooperation with regional centers: public or private entities involved in promoting economic growth in a specific area.

Particularly in Europe, similar resident-by-investment (RBI) and citizenship-by-investment (CBI) schemes have come under fire over concerns that they can help criminals and the corrupt evade sanctions and other legal accountability, as well as launder their ill-gotten gains. A report last year from the Financial Action Task Force (FATF) and Organization for Economic Development (OECD) noted that “Criminals have exploited a range of vulnerabilities in CBI/RBI programmes to perpetrate massive frauds and launder proceeds of crime and corruption reaching into the billions of dollars, while also hiding assets in less compliant or effective jurisdictions, facilitating organised crime and evading law enforcement.”

The EB-5 scheme has received comparatively less public scrutiny, perhaps due to requirements such as job creation that may make it less attractive than other programs for illicit actors. Nonetheless, money laundering concerns have been raised. A 2020 report by Transparency International Russia found that the program “faces serious corruption and money laundering risks” due to a lack of oversight, guardrails and transparency.

The real estate sector is particularly exposed. According to data compiled by Invest in the USA, more than two thirds of EB-5 capital investment, some $7.7 billion, made through regional centers from 2014 to 2015 went to construction-related industries. In the same period, non-construction related real estate investments totaled $2.85 billion.

One 2015 paper reported that EB-5 investments offer “extraordinary flexibility and attractive terms, especially to finance commercial real estate projects.” The authors cite the head of a then $50 billion partially state-owned Chinese development conglomerate who told journalists that EB-5 has “now become almost a conventional way [to raise capital] for large-scale developers in America”.

Two cases included in our report Money Laundering Risks in Commercial Real Estate demonstrate the problem.

Busting North Korea anti-nuclear sanctions

In 2017, the US government brought a civil forfeiture and money laundering complaint against a Chinese company, Dandong Chengtai Trading Co. Ltd, seeking over $4 million that the Department of Justice claimed were North Korean funds laundered by the company into the United States.

The complaint alleged that Dadong Chengtai and associated companies controlled by its owner Chi Yuping “comprise one of the largest financial facilitators for North Korea.” Dadong Chengtai imported North Korean coal into China, generating important revenue for the Pyongyang regime, and allegedly made US Dollar denominated transactions on behalf of North Korea to purchase commodities for import.

Also included in the forfeiture complaint was around $500,000 that Chi Yuping allegedly wired to a US bank account to pay for an EB-5 visa for his wife, Zhang Bing, manager of Dadong Chengtai. The payments were initially structured in smaller amounts to avoid Chinese capital outflow restrictions. Once the requisite amount had been gathered in the US account, it was transferred to an EB-5 regional center.

Zhang’s EB-5 investment joined over $7 million in EB-5 funds that the regional center in question transferred to an unnamed US company “engaged in a residential and commercial construction project,” according to the complaint.

Chinese businessman sells restricted tech to Iran; invests in now-defunct Cleveland medical showcase

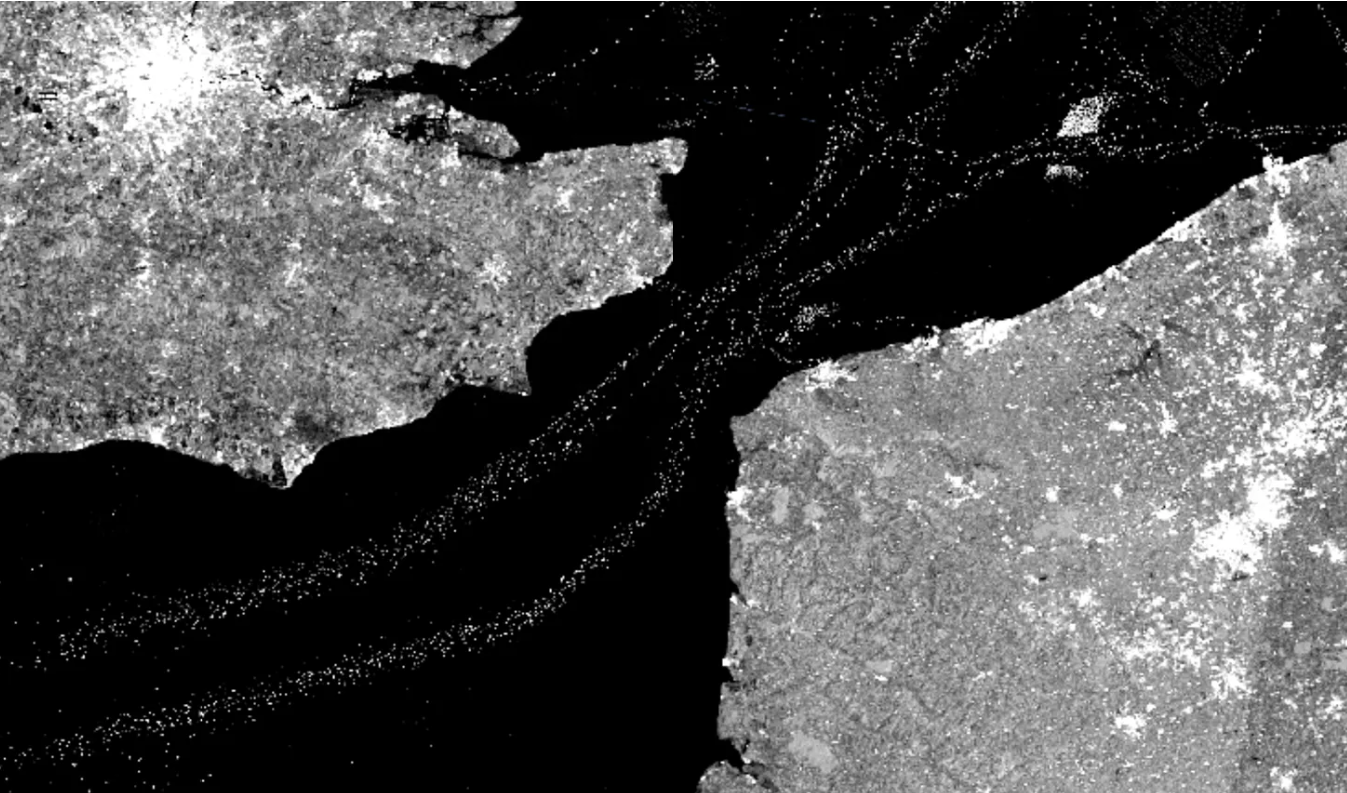

When it opened in 2014, the Medical Mart in Cleveland Ohio (pictured, above), “was hailed as a first-of-its-kind showplace for medical technology,” according to local news outlet Cleveland.com. “But it never took off.’

The facility was meant to be a permanent exhibition of the latest in healthcare innovations, attracting doctors and medical administrators to the city. After closing in 2020, the building is now being renovated to become part of the Huntington Convention Center of Cleveland.

The bill for Medical Mart, later renamed the Global Center for Health Innovation, and its recent renovation, was largely footed by Cuyahoga County taxpayers. However a regional center known as the Cleveland International Fund also appears to have brought in EB-5 investments as capital for related properties.

One such visa applicant was Wang Wei, also known as Jack Wang. His China- and Hong Kong-based front companies allegedly purchased US origin technology and illegally supplied them to sanctioned Iranian users.

In 2013, Wang transferred $545,000 to the Cleveland International Fund for an EB-5 investment in the “Medical Mart Hotel”. His share of the project became the subject of a 2018 civil forfeiture complaint brought by the Department of Justice.

Conclusions

Taken together with the prominence of EB-5 visa investments as a source of capital for commercial real estate ventures, these cases point to the need for the investments through the program to be specifically included in anti-money laundering rulemaking for the sector. EB-5 regional centers, immigration lawyers and other consultants participating in the scheme should be included in a ‘cascade’ of reporting requirements, collecting information on beneficiaries and the source of their funds where EB-5 investments involve commercial real estate.