SUBMITTED VIA FEDERAL E-RULEMAKING PORTAL AT REGULATIONS.GOV

Submitted: July 22, 2024

Financial Crimes Enforcement Network P.O. Box 39

Vienna, VA 22183

Attention: Director Andrea Gacki

U.S. Securities and Exchange Commission,

100 F Street NE, Washington, DC 20549-1090

Attention: Chairman Gary Gensler

Re: Customer Identification Programs for Registered Investment Advisers and Exempt Reporting Advisers (RIN 1506-AB663235-AN34) Docket Number FINCEN-2024-0011.

Dear Director Gacki & Chairman Gensler,

The Anti-Corruption Data Collective (ACDC) applauds the plan of the Financial Crimes Enforcement Network (FinCEN) and Security Exchange Commission (SEC) to require Registered Investment Advisors (RIAs) and Exempt Reporting Advisors (ERAs) to implement Customer Identification Programs (CIP), as described in the agencies’ May 21, 2024 notice of proposed rulemaking (NPRM).

As reflected in ACDC’s public comment[1] on FinCEN’s earlier proposed rulemaking “AML Requirements for RIAs and ERAs,” CIPs are an important part of anti-money laundering (AML) programs and this joint proposed rulemaking between FinCEN and the SEC is a necessary step in bringing RIAs and ERAs in line with the AML requirements for financial institutions under the Banking Secrecy Act. ACDC supports the proposed rule, which would require RIAs and ERAs to implement a Customer Identification Program (CIP) and sets minimum requirements for these programs, if, as proposed in the earlier FinCEN rulemaking, investment advisers are included in the definition of “financial institution” under section 326 of the Bank Secrecy Act (BSA).

While welcoming this proposal, we reiterate, however, our recommendation to strengthen the previous proposal. FinCEN should expand the definition of advisers beyond RIAs and ERAs to include two important types of actors not subject to the Investment Advisers Act of 1940, namely managers of family offices and of certain real estate-focused funds. Covering all private funds except family offices and real-estate funds will create an obvious and inviting loophole for illicit money and state-directed campaigns to target critical technologies. The recent conviction in a Manhattan federal court of the head of a large family office on charges of fraud and racketeering demonstrates the risks posed by leaving these private funds unregulated.[2] In terms of real estate funds, ACDC has recently published a report on illicit finance risk in the commercial real estate sector, jointly authored with Global Financial Integrity and the FACT Coalition.[3] Among the cases examined in the report is one in which a now sanctioned Russian billionaire made large-scale commercial real estate investments utilizing a private real estate fund.

ACDC welcomes the opportunity to submit public comments on this proposal. We believe that hedge funds, private equity funds, venture capital funds, and similar vehicles present the most urgent, serious, and complex illicit finance challenge facing the agency and the country. For that reason, this comment does not discuss other types of investment advisers that would be covered by the proposed rule.

ACDC is a collective of experts and advocacy organizations that makes innovative use of publicly available data to study transnational corruption flows and develop effective policy solutions. It is a project of the Fund for Constitutional Government (“FCG”), a 501(c)(3) nonprofit corporation based in Washington, DC.

ACDC’s Analysis of SEC Data

As described in ACDC’s earlier public comment on FINCEN-2024-0006, we have collected and analyzed publicly available data as of December 1, 2023, on the ownership of private funds currently managed by advisers reporting to the SEC.

The risks revealed by this analysis highlight the clear need for FinCEN and SEC, as proposed, to require RIAs and ERAs to identify their customers, verify their identities, and compare those identities against government lists of malicious actors.

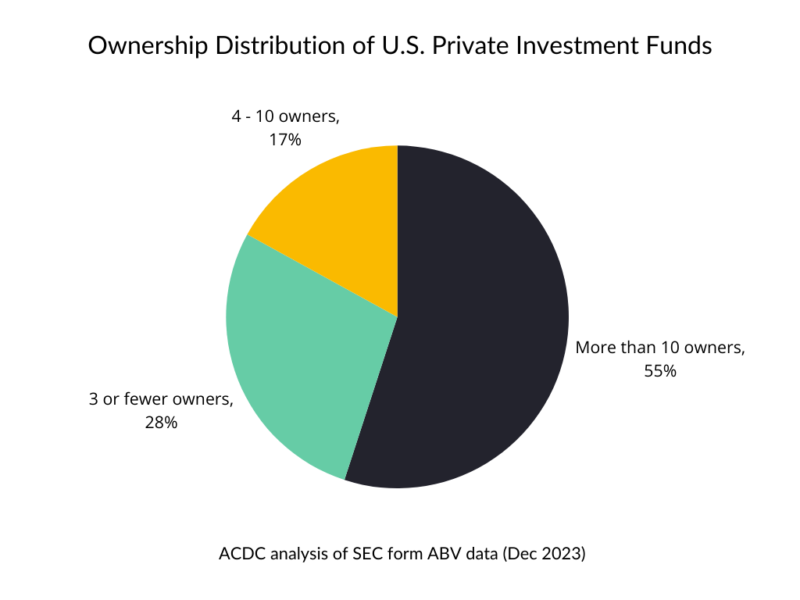

Our analysis shows that while most private funds have many owners, over one quarter of those funds, including many with significant assets under management, exhibit surprisingly concentrated ownership. On average, private funds that appear in the SEC registry report 172.4 unique beneficial owners. However, we observe 25,387 funds (or 45% of the total sample) that have 10 or fewer beneficial owners and going further, 15,850 funds (28% of the total sample) that list three or fewer beneficial owners.

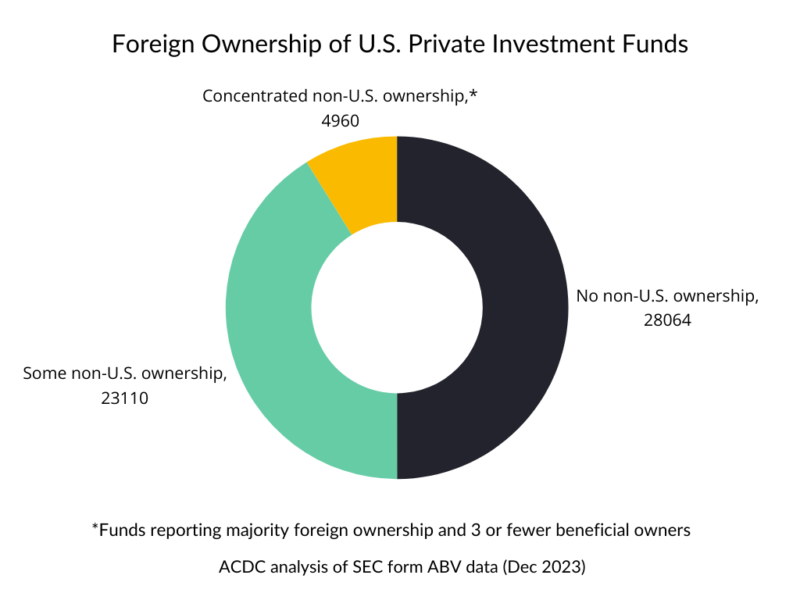

We also found that there are 28,070 private funds (50% of the total dataset) that have at least some (more than zero) non-U.S. ownership. If we multiply the percentage of non-U.S. ownership by the total assets under management for each fund, we see that there is a significant amount of foreign cash entering the U.S. financial system and economy through private funds: Out of $21 trillion in private fund assets under management, $8.4 trillion (40%) is owned by non-U.S. persons.

Finally, we observe 4,960 unique private funds that both list three or fewer beneficial owners and at least 50% non-U.S. beneficial ownership. Collectively, these funds with concentrated, as non-U.S. beneficial owners manage $1.7 trillion in assets. Such funds with a small number of investors are less diversified and may be of greater interest to the U.S. government for law enforcement, anti-corruption, or national security reasons.

Given the risks associated with inflows of anonymous and opaque foreign capital,[4] we consider it crucial that, as proposed, the advisor to the private fund is required to know and verify the true identity of their customers.

As noted in our previous comment,[5] there is a structural flaw in the present arrangement. Today, banks and broker-dealers are expected to profile their customers, understand their activity, monitor it for potentially suspicious activity, and report confirmed suspicious activity to FinCEN. However many of these financial institutions’ largest, most complex, most important, and most sophisticated customers are private funds. The lack of mandatory CIP requirements for RIAs and ERAs therefore undermines the efficacy of the entire AML system. As the proposal rightly recognizes, investment advisors have direct relationships with customers and may be best placed to efficiently perform CIP obligations.[6]

As certain corporate structures and offshore locations carry a higher risk of abuse for illicit purposes, FinCEN and SEC are correct to propose that, based on the advisor’s risk assessment of a new account opened by a non-individual customer, investment advisors will need to obtain information about individuals with authority or control over the account as part of verifying the customer’s identity.[7]

However, the proposed CIP rule does not require advisors to ascertain the identity of individuals with control over all private funds. Indeed, it applies “only when the investment adviser cannot verify the true identity of a customer that is not an individual using the [documentary and non-documentary] verification methods described in…the proposed rule.”[8] FinCEN must also go further and, as noted in our previous comment, promulgated a rule, as intended, that required investment advisors to private funds to collect information on the beneficial owners of all private funds.

As stated in our earlier comment,[9] ACDC does not object to FinCEN’s waiting to set out beneficial ownership requirements for advisers until the CDD Rule for banks has been aligned to the CTA. It is imperative that advisers to private funds be required to conduct their own determination of the beneficial owners of the limited partner investors. When FinCEN does promulgate beneficial ownership rules for private funds, though, it is also imperative that the ownership stake be lower than 25%. The 25% ownership threshold, which is high even for operating companies, would be essentially useless for private funds. Our analysis of the SEC data, described above, reveals that roughly 68% of all private funds (or 38,277 unique entities) are controlled by five or more beneficial owners. If the CDD rule is applied as currently written, many if not most of such funds would potentially not have to report the identities of any of their beneficial owners, since conceivably many of such limited partner investors would stay below the 25% threshold. If advisers to private funds are not required in practice to identify the beneficial owners of all significant legal entity limited partner investors, the value of the due diligence, transaction monitoring, and suspicious activity reporting will be substantially limited.

Conclusion

ACDC applauds FinCEN and SEC’s continued efforts to develop a strong AML regulatory framework around private investment funds. We would be pleased to discuss this important rulemaking process with you further and invite an ongoing dialogue with civil society. Please contact ACDC at team@acdatacollective.org.

Respectfully,

David Szakonyi, Director

Anti-Corruption Data Collective (www.acdatacollective.org)

A project of the Fund for Constitutional Government

[1] Comment #2024-02854 on FINCEN-2024-0006

[2] Matthew Goldtsein, “Jury Finds Archegos Founder Bill Hwang Guilty of Fraud and Racketeering,” New York Times, July 10, 2024

[3] Anti-Corruption Data Collective, Global Financial Integrity, FACT Coalition, “Money Laundering Risks in Commercial Real Estate,” May 1, 2024.

[4] Department of Treasury, “2024 National Money Laundering Risk Assessment,” p29 – 31

[5] Comment #2024-02854 on FINCEN-2024-0006

[6] https://www.federalregister.gov/d/2024-10738/p-193

[7] https://www.federalregister.gov/d/2024-10738/p-97

[8] https://www.federalregister.gov/d/2024-10738/p-97

[9] Comment #2024-02854 on FINCEN-2024-0006