COVID-19 Relief

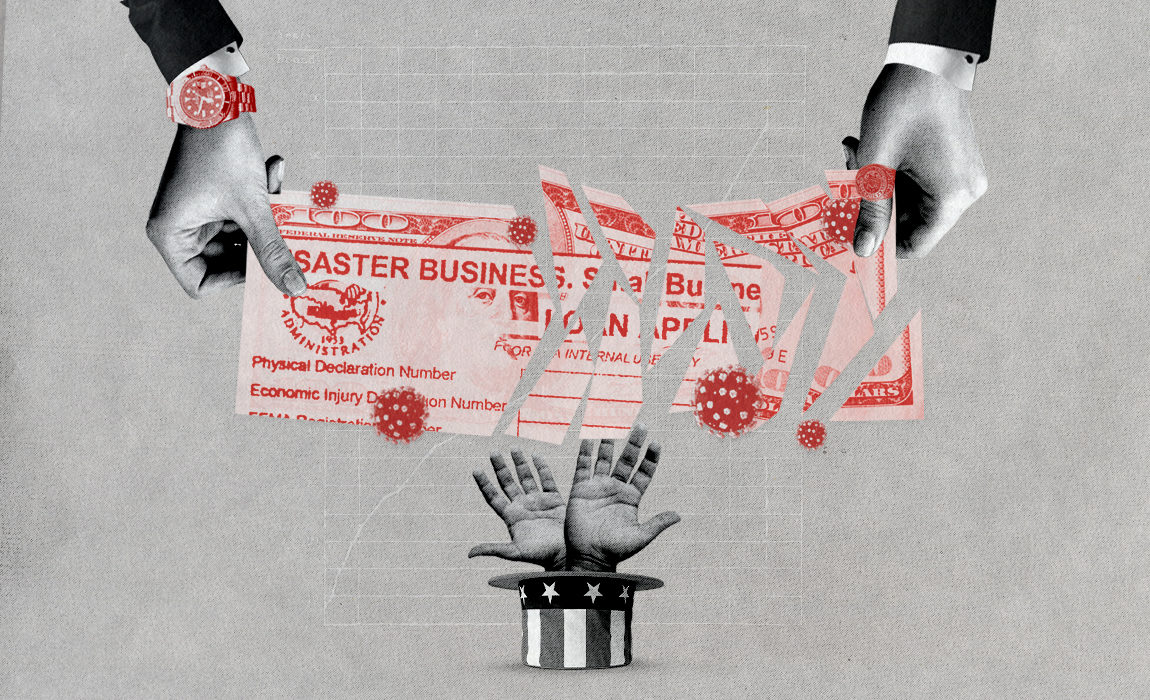

Misuse of federal COVID-19 relief funds

As the economic impact of the COVID-19 pandemic hit hard in spring 2020, the U.S. Congress passed an unprecedented multi-trillion dollar economic stimulus package involving multiple pieces of legislation and government agencies.

However, while Congress specifically intended taxpayer funds to go to workers and small businesses, particularly those owned by women and minorities, companies connected to giant private equity firms, Chinese state-owned companies, a multi-million dollar defense contractor, and a Ukrainian oligarch were able to access billions of dollars in public money.

In the background to this short-term crisis are many of the long-term issues in American politics, including the undue influence of powerful financial interests, authoritarian regimes and kleptocrats, as well as the lacking oversight over government spending that allows corruption to occur.

Recommendations for U.S. policymakers:

Following the publication of our report Public Money for Private Equity: Pandemic Relief Went to Companies Backed by Private Equity Titans, together with Americans for Financial Reform and Public Citizen, the Anti-Corruption Data Collective urges policymakers to include the following guardrails on any economic stimulus package:

- Public money should come with binding requirements that put workers first: All companies that receive public support during an emergency must keep workers on payroll, halt offshoring or outsourcing of jobs, maintain benefits (especially healthcare and sick leave during a public health crisis like the pandemic), refrain from undermining collective bargaining agreements, and endorse neutrality in union organizing efforts.

- Private equity firms and other investors should be prohibited from extracting value from companies that receive public support: Firms receiving public money should be prohibited from paying out dividends to investors, making stock buybacks, and paying lavish executive salaries.

- Recipients of public money should be banned from acquiring new companies as long as they are receiving public support: Companies that receive public support and private equity firms that own or back recipients should be prohibited from acquiring rival or complementary companies for two years to prevent public funds from subsidizing a consolidation wave during economic downturns.

- Small business programs should exclude investor-owned firms like those owned by private equity: Programs should not create exceptions to the size and affiliation rules, and the SBA must rigorously enforce them so that large companies or investment firms cannot indirectly access programs intended for genuinely small and independent businesses.

- Public disclosure around all public stimulus measures must be strengthened: The CARES Act lacked strong statutory disclosure provisions to enable the public and public officials to assess the federal measures that were taken to provide economic and public health.

Members working on this problem